May 14, 2013 – The Federal Reserve Bank of San Francisco is home to the Cash Product Office, the unit that provides operational and policy direction for the Fed’s vast cash services. As part of its remit to understand and predict cash demand, its President and CEO, John C Williams, recently published an essay entitled ‘Cash Is Dead! Long Live Cash!’.

This essay presents various statistics and facts relating to recent US currency volumes and payments that effectively contradict one another. The key questions Williams sets out to answer are ‘what explains the rapid rise in currency holdings at the same time that other methods of payment are displacing the greenback? And what is the future of cash? Are we becoming a society in which paper currency is obsolete? Or will the supply of currency continue to grow?’

In providing answers to these questions, he starts by listing the changes that are currently taking place, all of which would indicate the demise of cash – specifically the growing list of alternate payment systems such as credit, debit gift and prepaid cards, PayPal, mobile phones etc, as well as the trend to e-commerce. It would be logical, he says, to assume that cash is diminishing and is ‘doomed to go the way of the dinosaurs’.

He then paraphrases a quote by Mark Twain – ‘reports of the demise of cash are greatly exaggerated’ and goes on – ‘in fact, they are plain wrong’. The rationale behind his statement is simple– the quantity of currency keeps growing.

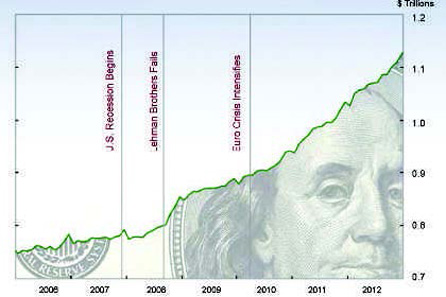

Rise in Circulation of US Currency 2006-2012. Source: Federal Reserve Bank of San Francisco.

Since the start of the recession in December 2007 and throughout the recovery, the value of US currency in circulation has risen dramatically and is now 42% higher than it was five years ago.

The essay states that there are two main reasons why people use cash – first as a medium of exchange because it is convenient, easy to carry, widely accepted, will work in all circumstances, is anonymous – and second as a store of value. But there are costs to holding cash as well, such as loss of interest and of secure storage for large sums.

Cash holdings tend to rise as the economy increases and during periods of political and economic turbulence, but fall when interest rates are high and the penalty of holding cash is great. They also fall if low-cost alternatives to cash are available. This covers the demand.

On the supply side, the Fed supplies currency elastically to the banking system – ie. if banks require cash for customers, the Fed supplies it and the cash in circulation goes up. When people want to hold less cash, the Fed takes it back and cash in circulation therefore decreases.

Growth in alternatives to cash – average annual percent growth in transaction volume 2000-09. Source: Federal Reserve Bank of San Francisco.

The Cash Paradox

Alternatives to cash have expanded dramatically in the US since 2000, which indicates the largest payment alternatives, to which should now be added pre-paid cards.

Also, the evidence points to the (market) share of transactions using cash, which is declining.

Growth in cash volumes versus GDP 1989-2011. Source: Federal Reserve Bank of San Francisco.

This claim is supported by the comparative growth of banknotes of $50 and less, ie. those used for everyday transactions, with the growth of the economy. Here we see that the total value of currency of all notes under $50 matched the growth in the economy until the mid-1990s and then falls behind it and never recovers.

Although some of this could be due to the greater use of $100 bills instead of $50s and $20s, the size of the gap suggests that people have turned to other means of payment.

However, despite all the evidence that people are using other forms of payment, the growth in the amount of currency in circulation continues to rise. Over the last five years, cash holdings increased on average by 7.25% annually, more than three times faster than economic growth over this period. At the end of 2012 the value of US currency in circulation stood at $1.1 trillion, or $3,500 for each person in the US. For the author the obvious question was ‘if people are not using this cash to pay for things, then what are they using it for?’

Putting Trust in Hard Cash

According to Williams, the difference between the growth of total currency in circulation and currency in denominations of $50 and smaller reflects the rapid growth of holding $100 bills. And the reason why people now hold more $100 bills than before the recession is because, as doubts about the safety of the banking system spread in late 2008, people – frightened of losing their savings – put their trust in hard cash. $100 bills were the logical answer – easier to conceal or store in bulk than smaller bills. In the six months following the collapse of Lehman Brothers in 2008, holdings of $100 bills soared by $58 billion, a 10% jump.

However, given that the financial crisis in the US ended in 2009, and confidence in the banks returned, the obvious question is – ‘why have cash holdings continued to rise?’ One reason given is the low interest rates, which lower the opportunity cost of holding cash and provide people with little incentive to put cash back into the banks.

But Williams maintains there is more to the story; in particular, Europe. As the euro crisis worsened in the spring of 2010, US currency holdings soared and continued to rise as economic and political uncertainty sent Europeans to convert euros to US dollars. According to an estimate from Judson, the share of US currency held abroad rose from about 56% before the crises to 66% in 2012.

The Future in an Uncertain World

The unusually large rise in cash holdings over the last five years reflects the unusual combination of low interest rates and economic and political uncertainty. Future demand for cash will be driven in large part by how these factors evolve.

But developments in alternative payment systems will also affect demand. If interest rates rise, the demand for currency is likely to decline somewhat, as it also will if political and economic uncertainty decreases. But if global economic or other events create more anxiety, the appetite for US dollars could surge anew.

If we ever doubted the link between politics and currency, William’s analysis should have left us in no doubt.

This article appeared in the April issue of ‘Currency news’.

In the same issue you will find further articles on the discussion of the future of cash and the role of cashless payment methods.