by courtesy of Currency News

September 10, 2013 – The Dutch Central Bank (DNB) recently conducted research into the psychological aspects behind choosing one payment method over another. Its motivation for the research was that in the Netherlands, despite commercial banks using publicity campaigns to encourage the use of debit cards and to introduce new payment methods, the migration from cash to electronic payments has not proceeded as quickly as expected. The DNB therefore sought to establish which psychological factors play a role in payment method selection. It believes central banks need insight into these factors because they point to the roles that payment methods will play in the future and because they help an authority to promote or discourage a specific means of payment.

Most research to date has assumed that consumers are rational decision makers; it is also more quantitative than qualitative and based on questionnaires rather than behavioural observations. The problem with questionnaires is that research subjects are inclined to give the answer they believe the researcher wants, and are often not even aware of what motivates their behaviour. No such drawbacks exist with direct observation, which is why DNB adopted this approach for its research.

The research consisted of three types of studies: literature, virtual-reality and neuroscientific. The latter two did not involve questionnaires and were innovative. The virtual-reality study involved direct observation of (virtual) behaviour, while the neuroscientific research involved direct observation of brain activity.

Literature Study

Most research was found to support the estimate that only 5% of our behaviour is conscious and planned, while at least 95% is unconscious. Decisions are mostly based on automatism, emotion, memory, intuition, environmental cues, and what we have been taught.

Habitual behaviour is an unconscious process that plays a very important role in how we make choices. To change habits is difficult but is easier to bring about when people are making new assessments. If behaviour is conscious, people can be encouraged to reassess their actions. In such situations, it is important to make the old habit less attractive and the alternatives more attractive. Stimuli at the point of payment are most effective, because people don’t usually decide how to pay until they actually need to do so. Retrospective stimuli appear to have little effect. Similarly, researchers found that newspaper articles about skimming/payment card fraud could reduce debit card usage, but that the subjects returned to their habitual behaviour after an average of just one day.

Payment Pain

That decision-making is unconscious and people do not always make rational decisions is supported by the psychological concept of ‘payment pain,’ defined as ‘direct and immediate displeasure or pain from the act of making a payment’. Such pain isn’t physical, but ‘psychological or hedonistic discomfort associated with making a payment’. There is a positive correlation between payment pain and the amount spent on a purchase.

More surprisingly, research indicates that the payment method used influences the level of pain experienced. The more transparent the payment method, the greater the pain. A payer is therefore more conscious of a cash payment – which is transparent – than a card payment, and this influences not only how much he is prepared to spend, but also the type of purchase he is inclined to make. Electronic payment allows more scope for impulse buying.

Virtual-Reality Study

The hypothesis for the virtual-reality study was that payment method choice is a form of habitual behaviour, and therefore cannot easily be manipulated.

The research involved an online game which simulated everyday life. Subjects were not told that the intention was to observe their transactional behaviour. Each participant had the opportunity to draw up to €70 in cash and to bring their preferred means of electronic payment (debit card, credit card). They ‘went’ to a virtual supermarket for their shopping and to a virtual restaurant for a meal. Once ‘inside’, they were able to select supermarket products from photographs or restaurant items from a menu. They were then asked how they would like to pay: by cash, debit card or credit card. During the course of the game, a number of variables were manipulated, without the subjects’ knowledge, to establish which factors led to the subject choosing a given payment method. The variables concerned environment, risk of skimming, spending budget, healthiness of food, friendliness of checkout staff, promotion of or cost of the payment method, prominence of the payment terminal, price roundness and time pressure.

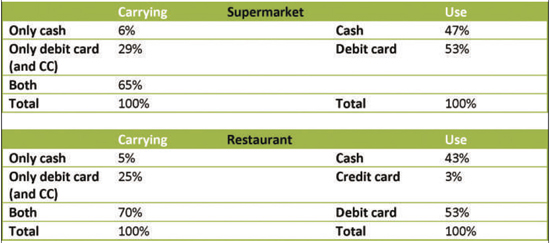

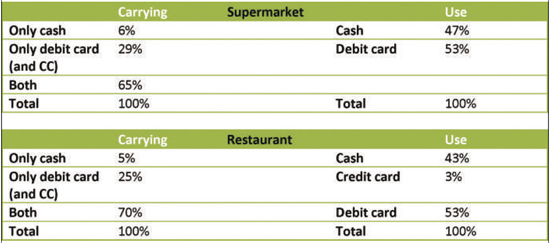

Decisions to carry and use the various means of payment.

Results

As illustrated above, by far the majority of subjects chose to take both cash and cards to both the supermarket and restaurant. Very few subjects took only cash and relatively few took only a card. Apparently, most people wanted to keep both payment options open for as long as possible. Some of the reasons given for deliberately leaving either cash or card at home were that the card was easier to carry than cash and that the card was only taken if large purchases were planned.

There was a roughly equal split in both the supermarket and restaurant between subjects choosing to pay cash and choosing to pay by card, although card use was marginally more popular.

Not all variables were found to significantly influence payment method choice.

People on tight budgets, for example, proved more likely to carry cash but were disinclined to do so when walking to their destination in the dark. The study found a correlation between income and attitude to cash – the lower a person’s income, the more likely they were to carry and use cash. The overall size of the transaction mattered: the larger the amount to be paid, the more likely the payer would use a card and, understandably, charging for card use led to more people paying cash.

Subjects with small budgets were more likely to decide to take one particular means of payment with them to a restaurant and their choice was mainly cash. No such effect was observed with supermarket shopping.

Card use was shown to increase in both supermarkets and restaurant when cards were actively promoted and was unaltered by the friendliness of the staff.

Neuroscientific Study

Neuroscientific research involves scanning the brain with a functional magnetic resonance image (fMRI). An fMRI measures changes in the oxygen levels in the more active parts of the brain. When a stimulus activates part of the brain, oxygen use increases there relative to adjacent parts. The fMRI scan records this as a 3D image showing where and when oxygen-rich blood is present, and therefore which parts of the brain are most active at the time of the scan.

It has been demonstrated that the parts of the brain that are active during decision-making are those responsible for pleasure and pain. By examining the relevant brain structures, it is possible to predict what choices people make before they are conscious of having made them.

The neuroscientific study for DNB examined emotional perceptions associated with making payments using various methods, an sought to address three questions:

1. To what extent is paying by cash or card guided by habit, unconscious emotions or other determinants?

2. To what extent do different age groups differ in their payment method preferences and to what extent are differences in emotional preferences or behavioural automation an inherent consequence of aging or merely a generational phenomenon?

3. What motivates the desire to carry cash even when one is not intending to use it?

The subjects were introduced to various virtual situations, in which there was uncertainty regarding the payment methods to be used. They were split into two age groups – 25 to 40-year-olds and 55 to 70-year-olds – and each group was further split into experienced card users and those with little experience.

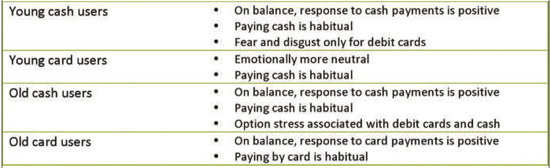

Responses to cash and card payments by young and older users.

Results

As summarised above, subjects generally experienced more emotions when they watched cash transactions, but trust in a card transaction was higher.

Stronger automatic behavioural responses were triggered with cash than card payments.

No general generation effect was observed. Both old and young cash users tended to be more emotionally engaged by cash, while card users were more emotionally neutral.

Young people had a stronger motor response to cash than card use, and even young card users appeared to have an unconscious wish to spend cash if they had it with them, despite indicating that they usually paid by card.

All groups displayed economic rationalism, except for the older cash users, by preferring to have both cash and card, rather than only one or the other. The fact that older cash users did not display economic rationalism may be because they preferred not to have to make payment method decisions.

Young people were more influenced by advertising videos that included payment activity, whereas older people had to use a card personally before their behaviour could be internalised – they were not influenced by social exposure. Therefore behavioural change can most likely be achieved by addressing each target group separately.

Conclusions

The main conclusions from the studies is that paying in cash or by an electronic method is not the outcome of a conscious choice, but is largely habitual and therefore difficult to influence.

One of a central bank’s functions is to increase the efficiency of payment transactions. At present, the focus tends to be on the social cost. In DNB’s opinion, authorities should also take into account the following when promoting or discouraging a specific payment method:

– The choice of method depends on a variety of implicit respectable motives;

– The transparency of a payment method influences spending behaviour;

– Moving people to a specific means of payment cannot be obtained by rationality alone; it is an evolutionary process, especially because payment behaviour is mainly habitual.

This article appeared in the August newsletter of Currency News.

To learn more about the newsletter and Currency News, visit its website.